In 2025, the landscape of plastics compliance is undergoing a fundamental transformation. What was once a voluntary move towards sustainability is now a formalised pathway to gaining competitive advantage.

By comprehending the new global plastics regulations, your company can transform compliance requirements into a strategic opportunity to lead the market, earn consumer trust, and safeguard your business’s future. This guide will show you how to stay ahead of the curve and turn regulatory challenges into lasting strengths.

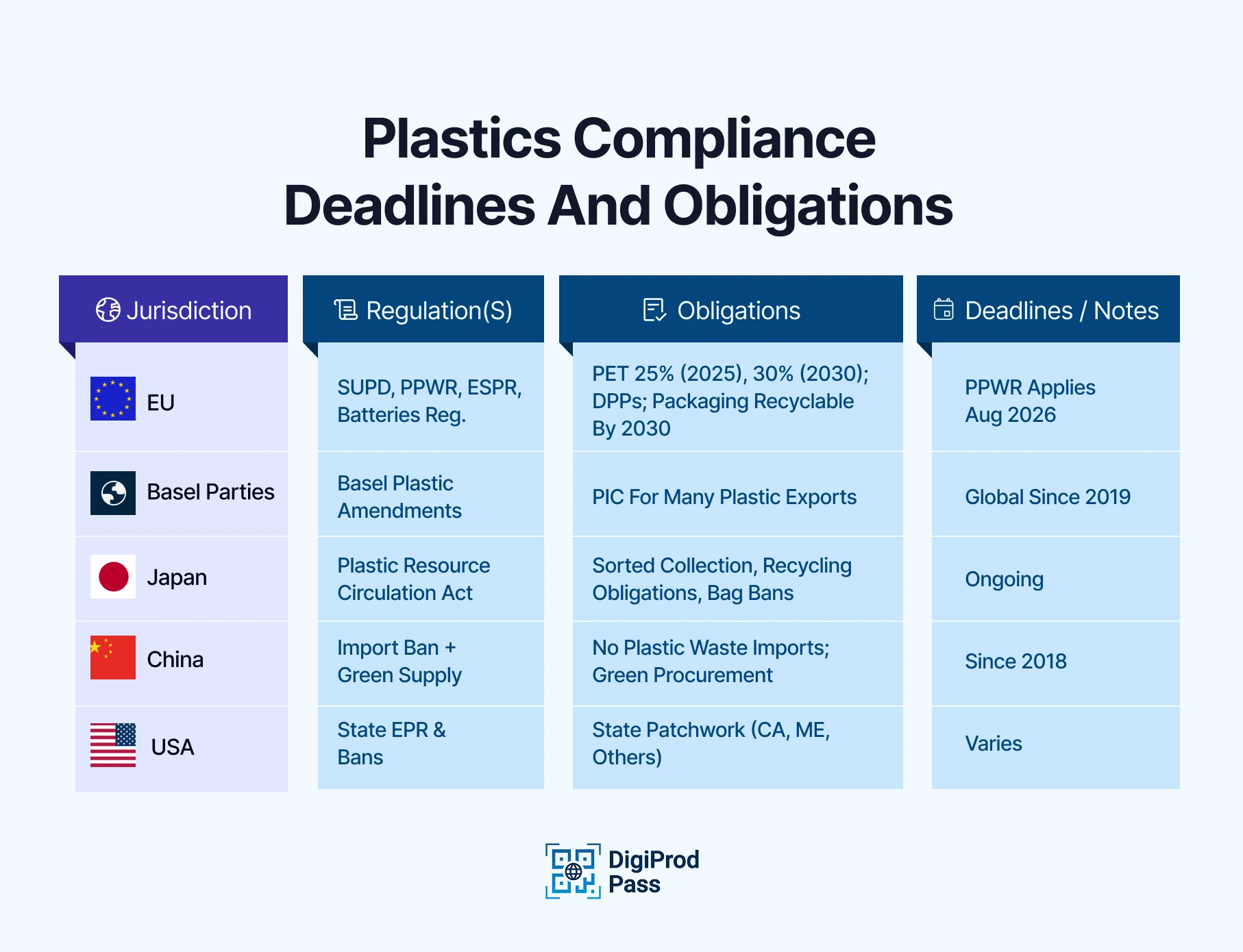

Plastics Compliance Priorities at a glance:

Trade compliance significantly impacts businesses, influencing market access, cost control, and operational efficiency. Non-compliance leads to product rejections, seized shipments, or fines. Early compliance streamlines supply chains, strengthens supplier negotiations, and can secure contracts through enhanced sustainability.

The Packaging & Packaging Waste Regulation (PPWR) entered into force in February 2025 and began applying from August 2026. It replaces fragmented national rules with a single, directly enforceable EU framework.

What it introduces

Why it matters

If you sell packaged goods in the EU, every SKU will face new compliance requirements. Packaging design, material choice, labelling, and reporting will all be scrutinised.

Actions to take

The Single-Use Plastics Directive (SUPD) directly affects beverage producers and any business using PET bottles.

Key deadlines

The Commission is also consulting on how chemically recycled content may count toward these targets (July 2025).

Why it matters

Non-compliant products risk being removed from shelves. Recycled content is no longer a claim — it must be verifiable and auditable.

Actions to take

Since 2019, many types of plastic waste have fallen under Basel Convention controls. Exporting plastic scrap now requires Prior Informed Consent (PIC) and proof that receiving countries have certified recycling capacity.

Why it matters

Weak paperwork or misclassified waste can lead to:

Plastic waste trade has become a regulated trade barrier, not a disposal shortcut.

Actions to take

The Ecodesign for Sustainable Products Regulation (ESPR) (in force since 18 July 2024) extends eco-design rules beyond energy products. Its biggest innovation? Digital Product Passports.

Digital Product Passports are designed to make traceability straightforward. Instead of relying on marketing claims, they embed verifiable product data into a standardised system cutting down the risk of greenwashing. By requiring companies to disclose key information on materials, recycled content, and supply chains, DPPs make transparency and data security a matter of legal compliance rather than choice.

Why it matters: Without a valid DPP, your products will not be allowed in the EU market.

Actions to take:

The Ecodesign for Sustainable Products Regulation (ESPR) introduces Digital Product Passports (DPPs) as the backbone of future compliance.

What DPPs do

DPPs shift compliance from what you say to what you can prove.

Winning companies treat plastics compliance as data infrastructure, not paperwork.

A practical path:

Platforms like DigiProd Pass enable structured data collection, role-based access, and scalable cross-border compliance — reducing admin costs while increasing regulatory confidence.

At the heart of all these regulations is Circular Economy Action Plan, a simple idea: plastics should stay in circulation for as long as possible instead of ending up as waste. That’s the logic behind recycled-content targets, reuse quotas and Digital Product Passports. They’re not just bureaucratic hurdles; they’re designed to push businesses towards products that can be reused, repaired, or recycled.

This necessitates a paradigm shift from a "take-make-dispose" approach to one that recognises the enduring value of materials beyond a singular application.

Packaging that’s easy to separate, bottles that can be collected and remade, or textiles that can be tracked through passports all fit into this bigger picture.

With proper implication of circularity, it cuts costs, secures supply of scarce recycled materials, and strengthens brand reputation with consumers who increasingly expect circular design as standard.

Taken together, PPWR, SUPD, and Basel rules mean plastics compliance now directly shapes trade feasibility. Waste exports, recycled content sourcing, and packaging design all influence whether a product can legally cross borders.

Miss the rules — lose the market.

Recycled-content targets are easy to announce and hard to prove.

Compliance depends on:

Without structured, auditable data, recycled-content claims become compliance risks.

EPR laws make producers financially and operationally responsible for packaging waste management.

EPR turns packaging data quality into a cost control issue.

Plastic rules are tightening worldwide:

Global businesses must manage multiple overlapping compliance regimes — one-size-fits-all packaging no longer works.

Plastics don’t stop at borders, and neither do the rules. Countries are finally starting to work together, whether through the Basel Convention or the ongoing talks for a UN plastics treaty.

For businesses, this means you can’t just think locally, exports, imports, and even suppliers abroad need to be checked against new global rules. The upside? If the world manages to align standards, companies that get their compliance house in order early will find cross-border trade a lot smoother.

Different industries are feeling the squeeze in different ways. Drinks brands are under pressure to hit recycled-content targets for bottles. Fashion and textiles have to prepare for Digital Product Passports that reveal what fabrics and dyes they use.

Electronics and car makers are looking at stricter take-back rules and material passports for parts. Even construction firms are being asked to rethink plastics in insulation and packaging. If your business cuts across sectors, the rulebook gets even more complicated, and the need for forward planning more urgent.

Laws aren’t the only force at play. Shoppers are becoming more demanding too. People want to know how much recycled content is in a bottle, or whether a garment can be properly recycled.

In Europe, new labelling rules will put that information in plain sight. For businesses, that’s both a risk and an opportunity: get ahead on transparency and you’ll earn trust, fall behind and you’ll lose it, even if you’re technically “compliant.”

The only reason some of these new targets are even possible is that recycling technology is catching up. Beyond the old model of shredding and melting, chemical recycling can now break plastics down to their building blocks.

Smart sorting systems and even digital watermarks on packaging are making it easier to separate plastics accurately. For businesses, this isn’t just good news, it’s a chance to partner early with innovators, secure recycled feedstock, and meet targets before competitors do.

All of this is tougher for smaller companies. Signing up to an EPR scheme or redesigning packaging can eat into margins fast. Gathering the kind of product data that Digital Product Passports will require can feel overwhelming if you don’t have an IT department.

Some governments are offering help, but for now many SMEs are left to figure it out on their own. The practical way forward is to team up, join collective EPR schemes, use simple cloud tools instead of bespoke systems, and start with your most common or highest-risk products first. Small steps still count, and they add up quickly.

Plastics compliance in 2025 is not about box-ticking. It is about staying in the market.

Companies that act early:

Those who delay will face higher costs, lost shelf space, and disrupted trade.

Is plastic compliance only an EU issue?

No. EU rules are the fastest-moving, but Basel, EPR, and national laws create global spillover effects.

What is the biggest operational risk?

Lack of verifiable, SKU-level data.

Where should SMEs start?

Focus on top SKUs, join EPR consortia, and use SaaS compliance tools instead of custom systems.

Basel Convention — Plastic waste amendments (overview):

EU Single-Use Plastics Directive (SUPD) — Directive (EU) 2019/904

https://environment.ec.europa.eu/news/commission-consults-new-rules-chemically-recycled-content-plastic-bottles-2025-07-08_en

Packaging & Packaging Waste Regulation (PPWR) — Regulation (EU) 2025/40

EU Packaging & Packaging Waste overview (European Commission):

Ecodesign for Sustainable Products Regulation (ESPR) — Regulation (EU) 2024/1781:

EU Batteries Regulation (includes battery passport/DPP requirements) — Regulation (EU) 2023/1542:

Japan — Plastics Resource Circulation Act (Ministry of the Environment, Japan):

China — Announcement on ban of solid waste imports (Ministry of Ecology & Environment, China):

.svg)

.svg)